ESI 3-year strategic plan “OneESI 2024 – Focus to Grow”

ESI Group (ISIN Code: FR0004110310, Symbol: ESI) announces its 3-year strategic plan focused on improving ESI Group’s topline and profitability. This plan will be presented and commented on Tuesday, October 5th, at 3:30pm CET during an Investor Conference.

"This 3-year plan will enable us to focus where we deliver the most value and therefore drive growth and profit for ESI that benefits all our stakeholders. This plan is an important milestone for our company, and it mobilizes the talent and energy of my entire team. I am very proud to lead a diverse team and I’m really confident that together we can achieve the expected result.”

Cristel de RouvrayChief Executive Officer of ESI Group

ESI’s performance is a paradox: ESI is a key technology provider operating in a vibrant market and yet profit and growth are far below comparable and stakeholder expectations. ESI’s management believes that to unleash its potential:

- ESI must focus on its core business to invest to win in key simulation markets;

- ESI must globalize its distribution to serve global customers, including a globally coordinated value packaging & pricing strategy.

The Group spent the past 7 months developing this “OneESI 2024 - Focus to Grow” plan to focus on the core business and globalize operations; in recent months, management spent time explaining to an extended team of key leaders the necessity and the credibility of this plan. ESI is now entering the next phase of communicating more broadly and executing on all facets of this transformation.

Financial ambitions for 2024

To increase its competitiveness, ESI must focus to grow. The Group has already made significant progress in this direction, as communicated during its H1-FY21 results, thanks to its healthy run rate initiative, the group posted both a growth in revenue and an improvement in profitability, and in tandem a sustained reduction in headcount and costs in the past year. The Group expects to continue with this trajectory, estimating a further reduction in headcount of approximately 5% by December 2022 and then a stabilization of headcount. This reorganization will be implemented in the various regions of the Group in accordance with the legal rules applicable to each of them.

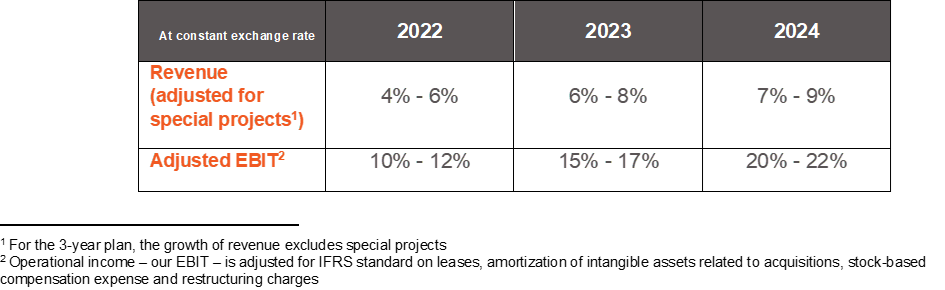

Accelerating in this direction, the Group announces its 2024 financial objectives. With its plan “OneESI 2024 – Focus to grow”, ESI aims to reach:

- A high single digit growth

- An adjusted EBIT to exceed 20%

To achieve this plan, ESI counts on its key levers:

- a confirmed opportunity in a growing and vibrant simulation market

- a renewed operating model

- a best-in-class governance

- committed teams

By building off its accelerators, the management ambitions a higher growth beyond this 3-year horizon.

More details

To present its “OneESI 2024 – Focus to grow” plan, ESI is organizing an Investor Conference which will be held on Tuesday, October 5th, 2021 at 3:30pm CET. To access it, click HERE.

Upcoming events

- Q3 revenues – October 28th, 2021

- FY21 sales and results - February 28th, 2022

Forward-looking Statements

This release contains “forward-looking statements”. These statements are subject to a number of risks and uncertainties, including those related to the COVID-19 virus and associated further economic and market disruptions; further adverse changes or fluctuations in the global economy; further adverse fluctuations in our industry, foreign exchange fluctuations, changes in the current global trade regulatory environment; fluctuations in customer demands and markets; fluctuations in demand for our products including orders from our large customers; cyber-attacks; expense overruns; and adverse effects of price changes or effective tax rates. The company directs readers to its Universal Registration Document – Chapter 3 presenting the risks associated with the company’s future performance.